Portolani Quarterly Newsletter Q2 2025

The second quarter of 2025 was extremely volatile. The quarter began with a sell-off in US equities. The market was very nervous about the announced trade war initiated by President Trump. When it became obvious that final tariffs were going to be lower, the market regained confidence. In 2025, the Portolani selection is up 2,23% versus -2,66% for the iShares MSCI ACWI ETF, driven by strong performances of the value managers and European small caps.

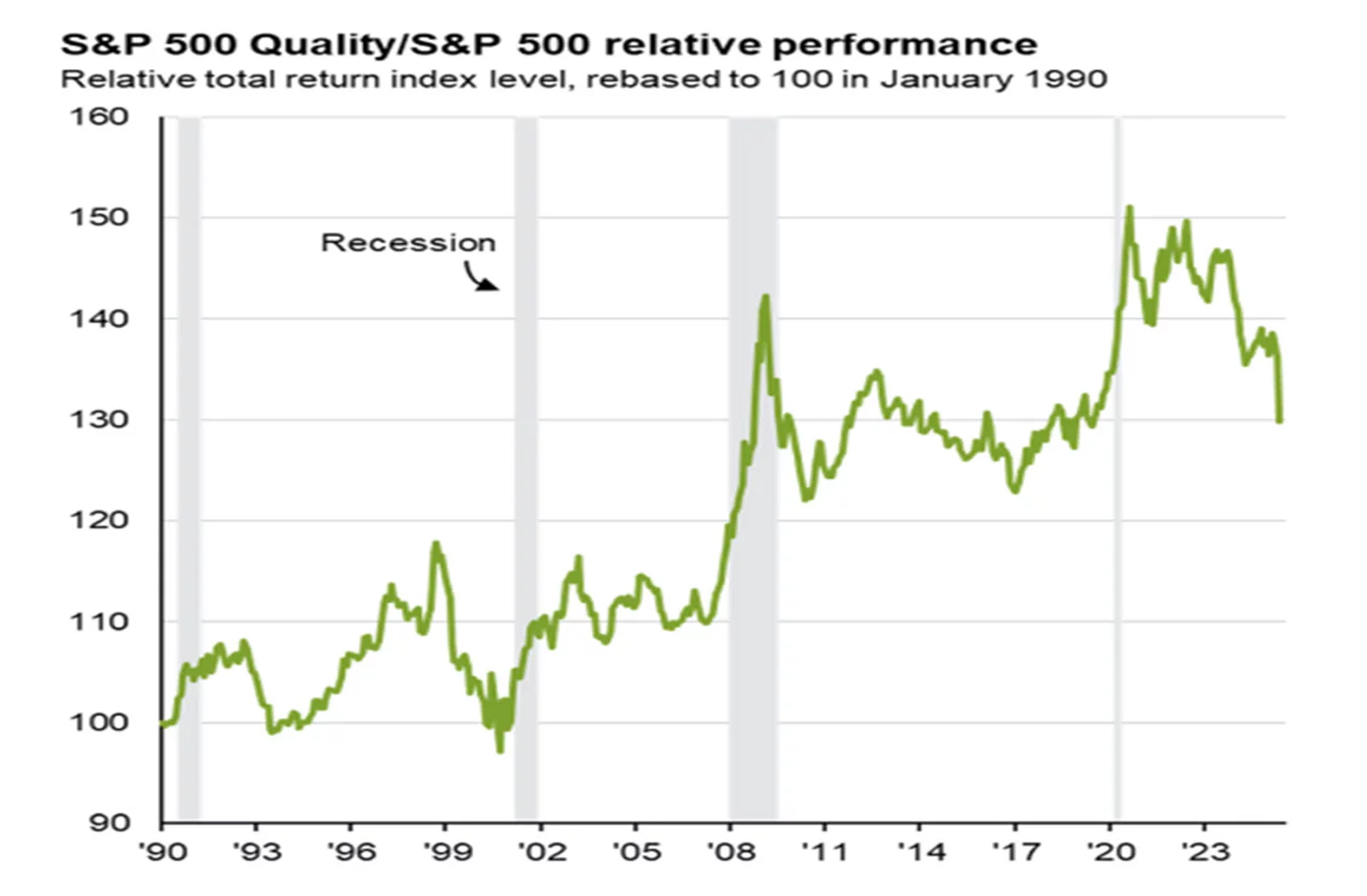

Quality stocks, characterised by strong free cash flow generation, low debt levels, strong management and stable business models, have been sold off in the last couple of years. The quality factor has however proven to work over time. In times of recession, when the focus of investors is more on fundamentals then quality tends to strongly outperform the overall market. The last couple of years, the focus of the herd of investors is more on future growth than on fundamentals.

The Portolani selection outperformed on:

Especially value stocks and European small caps performed very well over the quarter. Europe continues to be the best performing region in 2025. Driven by the financial bazooka of Germany, lower interest rates, prospect of less regulation, massive investments in weapons and increasing earnings growth, European stocks outperformed the rest of the world.

Value: Brandes was slightly down over the quarter (-1,19%) but stayed ahead of the index. Financials contributed to performance, but pharma performed weak due to uncertainty of the tariff trade war. Robeco (+3,5%) profited from its financials exposure and strong performance of Tesco, a top position in the fund. Magallanes (+7,96%) continued to surf on the discovery of European industrial companies and the rediscovery of European small caps.

Small caps: Performance inside the small caps continued to be very widely with global small caps up 3,4% and European small caps up 10%. We visited the manager of Lightrock (global small caps) in June. The team continues to find well managed quality stocks trading at very low prices. The fund gained 2,1% over the quarter. Alken, invested in European small caps was again the best performer with a gain of +20,4% in Q2, driven by industrials, weapon stocks and some telco’s. Since start of the year, the fund is up +43,7%.

The Portolani Selection underperformed on:

Quality: Artisan Value was the best performer and lost a minor 8 basis points. The higher exposure to banks helped performance. Also Heidelberger contributed strongly. Guardcap (-5,8%) could not profit from strong underlying fundamentals. Yacktman lost -4,6% (mainly US exposure), MS Global Brands was down -3,7%, partly because of negative news around payment networks like Visa and Mastercard.

Growth: growth stocks were picked up after the sell-off in April. Because the growth funds are severely underweight the magnificent 7, the magnitude of underperformance was huge. Seilern lost -2,5%, Artisan Global Opportunities made +2,2%. GQG lost -8,5%. The fund repositioned itself into Utilities, consumer staples and financials, at the expense of IT and consumer discretionary.

Emerging markets: GQG underperformed the market (-3,3%); Robeco was up 4,3%. The decline of the USD and the fact that tariffs were not as high as initially announced, drove the market higher.

Private Markets review

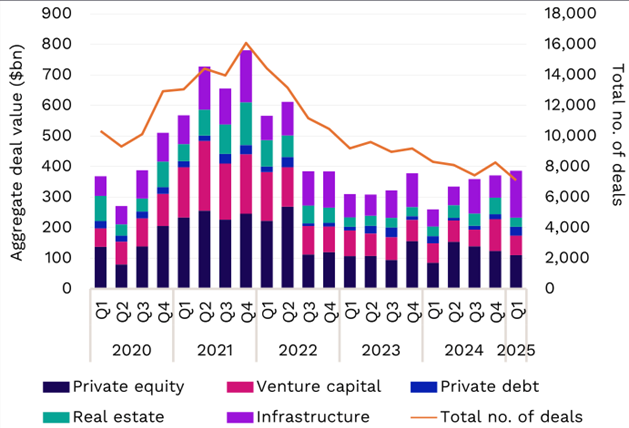

2025 investment activity remains muted: market optimism from Q1 does not really translate into strong transaction volumes, and activity has been lackluster at a stable level for 3 years.

Infrastructure investments remain so robust in light of the massive global investment needs that they now represent a uniquely high proportion of total deal volume.

Within the Portolani funds selection, we notice a clear increase in material distributions, mostly from Credit funds and Secondary funds, but also Buyout ones (such as the recent sale by EQT of IFS, an enterprise software provider, for 15 bEUR to several pension- and sovereign funds).

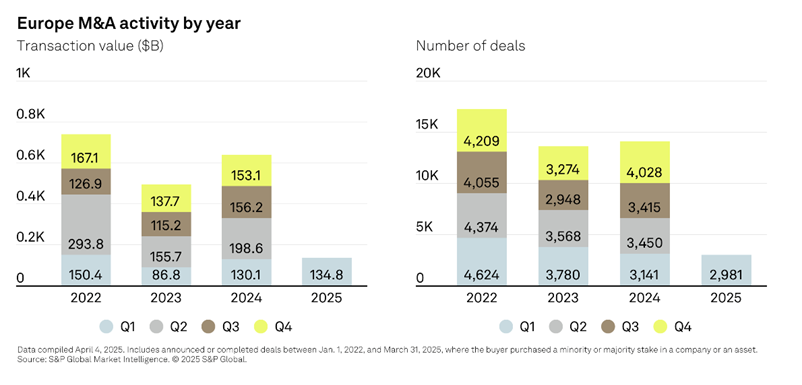

It is still too early to speak about Q2 volumes in detail, but the US tariffs announcement in April impacted general sentiment, with an ability to complete only the best quality transactions. Europe remains flat but shows a slight optimism in Tech & Software activity at +8%. US volumes have showed a more tangible optimism, with a rebound both in deal count and value, with mega deals taking a more visible role. (source: PWC end June report)

Chart: Private capital quarterly deal value and volume by asset class

Portfolio valuations depend on many factors, but the three main ones are: financial performance of portfolio companies, valuation multiples, and exit activity. All three factors are relatively healthy today after two years of “adjustment” post-Covid exuberance. We are particularly optimistic about a potential deal-making improvement on the Venture Capital side: we start seeing investment activity (“up-rounds”) that enable funds increase portfolio valuations, but IPOs are just getting started again.

European Private Equity

European Private Equity markets’ performance is deeply related to M&A activity, which remains relatively flat and subdued, focusing on tech-driven and sustainable investments, though fundraising and geopolitical uncertainties remain challenging. It is too early to speak about a real rebound.

- Market Recovery and Deal Activity: In Q1 2025, Europe recorded 135 bUSD across close to 3.000 deals, indicating a relatively stable activity at levels that do not enable PE portfolios to decrease: portfolio companies stay longer and longer in portfolios, urging GPs to find alternative routes to generate liquidity for LPs (continuation vehicles, NAV lending, etc). Q2 data is not yet widely available but we expect a similar momentum as Q1.

- Fundraising Challenges: Fundraising remained tough, with global closed-end fundraising down 28% to 104 bUSD in 2024, the lowest since 2012. In Europe, traditional commingled funds saw a 24% year-over-year decline, though alternative capital sources like separately managed accounts and co-investments provided a boost.

- Sector Focus: Technology, Media, and Telecommunications (TMT), along with pharma and healthcare, were top sectors for PE investment in 2024, driven by growth potential and resilience. The industrials sector saw a surge in M&A activity, with 1.800 deals worth 135 bUSD, often involving strategic buyers or carve-outs.

- Digital Transformation and AI: Digital tech, particularly AI and data analytics, is a priority for value creation. In 2024, 71% of PE firms invested in digital transformation, with 81% focusing on data analytics and 67% on AI, a trend expected to continue into 2025.

- Public-to-Private (P2P) Deals: P2P transactions gained traction, with a 65% increase in total value in 2024. Notable deals included the 13 bEUR acquisition of Nord Anglia Education (EQT and Neuberger Berman) and the 8bEUR takeover of Opella Healthcare Group. We notice more and more creative syndications with GPs calling to the wider public for coinvestment via dedicated SPVs or investment platforms.

- Regional Variations: The DACH region lagged with a 6% drop in transactions to 549 and a modest 0.2% rise in deal value to 57 bEUR. However, 58% of PE firms surveyed have investments in Germany, with 98% planning to continue and 39% aiming to increase investments over the next five years. The Nordic region showed resilience, focusing on green transition and tech-enabled assets (source: Roland Berger).

- Geopolitical and Macroeconomic Factors: Geopolitical uncertainty, including US tariffs, has led PE investors to view Europe as a diversifying complement in global portfolios. Despite optimism (56% of reviewed investors expect market improvement in 2025), concerns linger about economic growth, with 11% anticipating a recession.

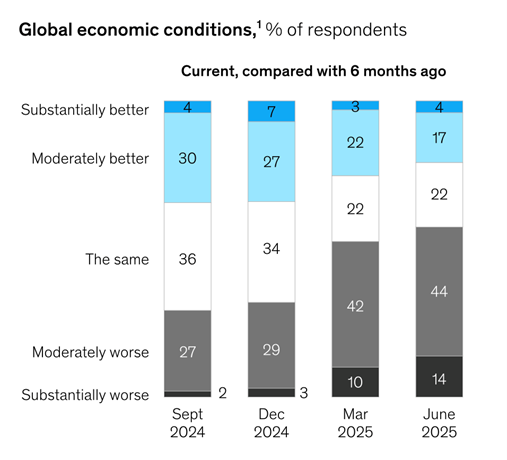

- Investor Sentiment: 46% of PE firms plan to increase investments in 2025, 44% aim to maintain levels, and only 10% expect to reduce activity. However, caution persists due to hazy buyout deal outlooks, as noted by industry giants like Blackstone and Apollo. (source: PWC). The April announcement about Trump’s tariffs has clearly impacted investors’ sentiment about global economic conditions as visible in the graph below:

Source: McKinsey 30 June report

- Sustainability and Innovation: Sustainability and technological innovation, especially in the Nordic region, are key trends. Investments in green transition assets like H2 Green Steel highlight this focus.

American Private Equity

American Private Equity activity in early 2025 showed resilience with increased deal activity and exits, despite fundraising challenges and prolonged holding periods. Focus on industrials, healthcare, AI, and alternative capital sources are shaping 2025, with macroeconomic and geopolitical factors posing ongoing risks.

- Market Rebound and Deal Activity: In Q1 2025, the U.S. contributed significantly to Europe’s deals volume (as per paragraph on Europe above), reflecting continued momentum.

- Fundraising Struggles: with less dynamic distributions, fundraising remains challenging, and as often in those cases, capital concentrated among the largest, most experienced funds, with the top 10 funds capturing 36% of raised capital, and 40% going to funds raising $5 billion or more. Alternative capital sources, like separately managed accounts and co-investments, provided a boost to assets under management (AUM)

- Sector Performance: Main sectors remain Technology, Healthcare and Industrials. Energy infrastructure, particularly clean energy, remains a bright spot in 2025, driven by investments in renewable energy and climate tech.

- Exits and Liquidity: Q1 2025 saw exits drop to a two-year low of 81 bUSD. Sponsors increasingly used alternative exits like sponsor-to-sponsor sales, minority investments, and continuation funds due to slowed traditional exits like IPOs. Long holding periods (averaging five years in 2023-2024) and pressure to return capital to limited partners (LPs) drove these strategies. 31% of portfolio companies have been held for 5+ years, a testament to the slow rotation in capital deployment/allocation. (source: Pitchbook). But IPOs are slowly appearing again with 25 traditional IPOs in 2025 (until end May, source: Dealogic).

- AI and Technology Investments: Investment in generative AI (GenAI) surged, with 407 mUSD average funding rounds in 2024 (up from 133 mUSD in 2023). However, fewer companies (171 vs. 273 in 2023) received funding, indicating consolidation around high-potential firms (read: pre-IPO situations). PE firms prioritized AI and data analytics for due diligence and operational efficiency, a trend that is expected to intensify in 2025.

- Macroeconomic Factors: Easing inflation and interest rate cuts improved the dealmaking environment in 2024. However, uncertainty around U.S. tariffs and strong labor markets slowed rate cuts in early 2025. Despite this, 30% of LPs surveyed plan to increase PE allocations in 2025, buoyed by PE’s long-term performance.

- Public-to-Private (P2P) Transactions: P2P deals grew globally, with the U.S. contributing to a 65% increase in total P2P value in 2024. These deals, alongside carve-outs, helped accelerate capital deployment amid robust credit and equity markets.

- Outlook for 2025: Optimism prevails, with expectations of continued dealmaking growth driven by high dry powder levels (near 2023 peaks) and improving market conditions. Funds with differentiated strategies and consistent performance are likely to lead, though short-term recent underperformance compared to large-cap U.S. stocks (S&P 500 up 23% in 2024) remains a concern. “Retailification” of Private Equity tends to create short-termism in investors’ mind.